IN-D PayGen application is available through Finastra’s FusionStore. IN-D.AI’s engine understands documents and images, extracts data and synthesizes it into actionable information, thus automating the document to data to decision process. For most financial institutions (FIs) paper or fax-based based payment initiations requires manual processing of requests, which is a slow, expensive and error prone process. IN-D PayGen using the IN-D core engine converts an incoming paper-based payment initiation requests to a SWIFT message with high accuracy. The IN-D PayGen understands various payment initiation requests, independent of templates and formats,. Training on new templates and formats is a zero-code process leveraging IN-D machine learning (ML) based self-learning capability. This ensures a quick deployment at minimal cost. This will ensure the FIs are able to give their end customers a superior customer experience while reducing processing risks and costs.

Going live on FusionStore marks the final stage of the app development journey for firms using Finastra’s open development cloud platform, FusionFabric.cloud. The FusionStore enables Finastra’s more than 8,500 banking customers worldwide to access, test, purchase and deploy certified apps on top of their core systems, helping them quickly realize the benefits and deliver added value to their customers.

Using Finastra’s open APIs, developers can create solutions that address business challenges across the financial services spectrum, including retail banking, payments, transaction banking, corporate banking, lending, treasury, and capital markets

The Challenge

In many financial applications, physical documents remain essential. Even when documents are scanned

or supplied in PDF or image formats, computer systems cannot easily and reliably extract the data within

them. This is a major barrier to the many advantages of fully digital operation, such as automation,

remote working and agile delivery. Plus, manual handling and inefficient processes, particularly for

documents that have regulatory significance, leads to increased costs and manual operations inevitably

introducing a greater risk of error, with knock-on consequences for operational and regulatory risk. In-

house AI development is possible – but costly, as the customer has to pay to train the models.

Key Features

- Understands multiple document layouts

- Pre-built integration with BPM and RPA solutions including Microsoft Power Automate and BluePrism

- ISO27001 certified

- Converts documents into payment initiation requests into SWIFT messages

How it works

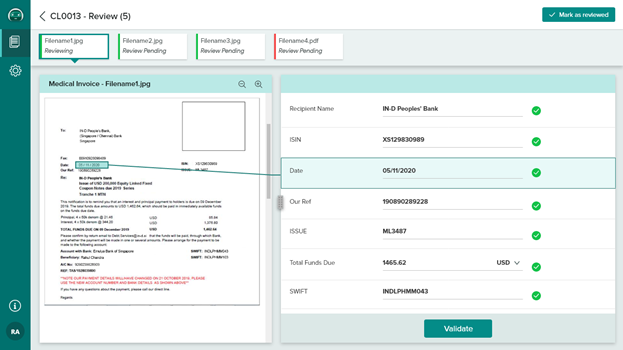

IN-D PayGen uses artificial intelligence to read, understand and extract information from documents.

Combining AI, computer vision and natural language processing, it solves some of the major document-

to-data challenges in financial systems, supporting data extraction from all document types, for example

PDF and scanned JPEG, TIFF and PNG. Automating the payment generation into Finastra’s payment

solution, FusionFabric.cloud platform.

Sample use cases include:

- Reading incoming payment mandates or messages to automatically create a SWIFT message

- Automating KYC processes by reading ID documents and details and recognizing faces on still or

moving images - Reading bank and financial statements to perform routine calculations, enabling credit analysts to

focus on high-value decisioning

IN-D PayGen uses a micro service architecture with both SaaS and on-premise deployment options. REST

APIs allow for seamless integration. Because the core document-to-data engine understands different

document layouts and has specific domain intelligence, it can be trained on just a small sample of

documents and implementation times can be cut to a matter of weeks.

Benefits

- Reduced operational, fraud and compliance risk as IN-D Paygen automates essential regulatory checks by seamlessly interacting with Fusion Global PayPlus through Finastra’s FusionFabric.cloud

- Automated back-office operations that reduce costs, improve STP and streamline the customer experience

- Lower-cost payment initiation: direct connection to Fusion Global PayPlus via FusionFabric.cloud enables payments to be initiated automatically, reducing costs and the risk of errors

- Ability to manage an increased capacity of transactions that are initiated via non-digitized documents

- Smarter decisions, with insights generated from data in archived documents