WHAT IS NEW?

New areas for Document-to-Data-to-Decision automation

Much Improved IN-D Core Doc Element Identifier (DEI) V1.1 Released in December

IN-D’s core DEI (patent pending) is a pipeline of object detection and block reconciliation

(post OCR) deep learning models designed to locate and extract important information

across a large variety of different document types without the need for a large data set for

training. With the this new release customers can look forward to:

- Expedited Transfer Learning based training for newer document set. E.G. for a

Large Global Airlines DEI v1.1 gave a 90% accuracy rate on reading RT-PCR test

reports with just 20-30 reports from each country - Proprietary Table Detection and Reconstruction model that now works at par or

in some specific cases, like Invoices and Bank Statements, better than platforms

such as Azure Form Recognizer and Amazon Textract. IN-D DEI can now not only

detect Tables across multiple pages but also similar tables across multiple pages.

Finally, this service is now available as a stand-alone API. - Fraud Detection models integrated to weed out photoshopped Identity cards

Please stay tuned for further announcements on IN-D DEI, we are now solving problems of,

to name a few, Generic Document Fraud detection, Nested tables and simply adding to the

element lists of commonly identified document elements.

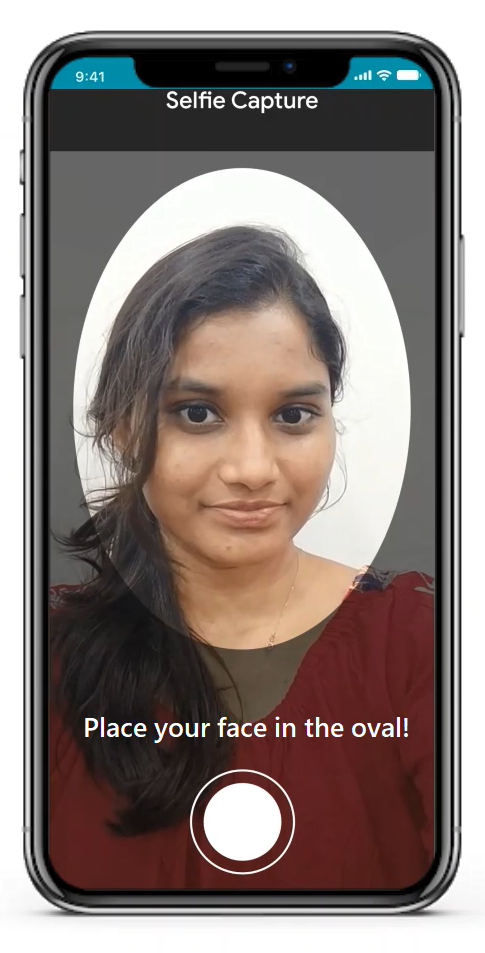

Liveness check and anti-spoof capabilities on mobile without internet

For companies that have their apps published on the Play Store or AppStore, we are launching SDKs for easier access to IN-D’s Identity Verification solutions. These SDKs now support both Gesture and OTP based liveness checks, lighting condition checks test, image blurriness check, open eye check etc., to ensure an ideal ID card and face capture. Enterprises can add these capabilities right into the mobile devices of their customers to ensure top-notch customer experience delivered. The best part is the fact that this can operate even without the internet! Yes, the capture and the liveliness check can happen even without internet connection, the images can be stored locally and uploaded for digitization & document forensics when the internet gets stabilized.

WHAT IS BETTER?

Rapid Advancements in AI Means IN-D Products Have Exciting Releases

Setup back office automation for Income Analysis

In the real world, documents/images uploaded by customers will not always adhere to the

norm or quality standards required to read information from them. IN-D now has capabilities

to automatically split multiple documents (such as ID cards) on a single image and process

them as separate documents.

The AI engine has been trained on thousands of samples to detect document boundaries in

a PDF page and documents scanned in different orientation, skew, etc., are not a

constraint here. The detected boundaries are then cropped and considered as separate

documents for classification, extraction and face match (In case one of the document

images is a photograph of a face).

Improvements in Income Analysis module for a much faster data verification

Old ways of Underwriters spending days on sanitizing and verifying income proof

documents such as Bank Statements, Salary Slips etc. are now passé. With new

verification capabilities listed below they can now do the job in minutes, YES Minutes!!!

- Wrong table-cell navigator that helps the user to easily navigate to the table cells

flagged by AI for manual confirmation - Pick-data popup that helps the processor to pick any text written in the document

just by clicking or dragging - Magic-grid that helps the processor to reassure the table structure if the document

has crammed columns or rows - Split / merge documents, rotate skewed pages, and delete unnecessary pages

before sending it to digitization - Rejection flows to streamline collecting better/correct documents in case of wrong

uploads