WHAT IS NEW?

New areas for Document-to-Data-to-Decision automation

Automating Due Diligence in Structured Finance Transactions

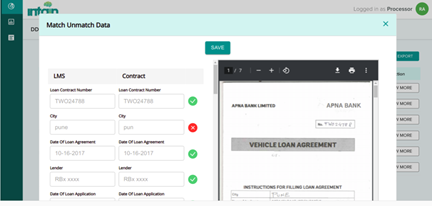

Verification agents are engaged to perform due diligence on loan pools in structured finance transactions. This is time consuming, limits the sample size and is a costly affair. IN-D’s loan data verification solution automates the process by reading the loan contract and reconciling it with the data from loan management systems (or excel sheets). It reduces the cost by up to 80% and allows increased sample size even up to 100%.

IP – Doc Element Identifier, Doc Classification, Face Liveness

Following up on a patent filed for the Doc Element Identifier (DEI), IN-D has filed patents for a VGG16 based document classification that increases the accuracy of classification and makes it faster if the classification is in the image domain and does not need OCR as a prerequisite. This ensures that IN-D’s KYC solution has industry leading accuracy on identifying ID cards. Some financial institutions in India who already invested heavily in other KYC products are adding IN-D for ID card classification, as this removes the drop-down menus and also removes one point of error.

Face Liveness model which is based on further work on an earlier paper provides for liveness check with high accuracy without access to cloud based systems.

WHAT IS BETTER?

Rapid Advancements in AI Means IN-D Products Have Monthly Releases

Income Analysis – Salary Slips & Bank Statements Digitization

IN-D Income Analysis is now feature-rich with key capabilities like transaction type mapping, running balance check, and could do 50+ calculations out of the box. Based on the transaction type, IN-D automatically matches the salary with the digitized pay slip and many other workflow checks to ensure fraud-proof credit assessment.

Active Learning in Invoice Processing

Upon the completion of augmented training of Machine Learning models with thousands of samples from different countries, IN-D Payables has successfully implemented the continuous learning capabilities to the ML model. With this, users will be able to improve their model accuracy by marking their production data for model enhancement. Users are also given options to revert back to the base model in case there is a drop in post enhancement accuracy due to issues like overfitting.

PARTNER WORLD

New Partnerships and Updates on Current Partnerships

IN-D KYC in Indonesia

IN-D’s Identity Verification platform is now in Indonesia, thanks to the partnership with RDS. Similar to Vietnam KYC, IN-D has built self learning models to train on different ID cards in Indonesia that ensures recognition of document types and extraction of key attributes from different Indonesian ID cards. It is high time that IN-D is quickly expanding across different countries in South East Asia crossing the language barrier,

IN-D and ASG Zenith

ASG Technologies, a Rocket company, and IN-D entered into a partnership to add cognitive “Document-to-Data” capabilities into ASG’s Digital Automation Platform, Zenith. With this partnership, customers across industries can design their own fully automated processes as varied as Identity Verification including eKYC, Income Analysis, Accounts Payable and Health Claims Automation using IN-D’s solutions with Zenith’s low code automation platform.